MISSION

To establish and operate AMEZ as a world class facility for our valued entrepreneurs and stakeholders while serving as a pioneer Economic Zone (EZ) for the sustainable growth of Bangladesh.

VISION

To become the global ambassador for Bangladesh and a catalyst for the economic and social development of our country, thereby transforming Bangladesh into a middle income country by 2021 and a developed country by 2041 through the establishment and continuation of world class customer services at our state of the art facilities.

CORE VALUES

• Nurturing and serving the needs of all people (employees, customers, and those in our community) while providing them with the opportunities to reach their full potential.

• Structuring, implementing and applying world-class policies for the development and operation of our economic zone for the benefit of all our stakeholders.

• Contributing to the prosperity of any individual or company associated with AMEZ through the use of modern technologies to ensure high quality products and services through a dedicated, committed, well-trained and motivated workforce.

• Investing in the future of our people and our business to realize our goal of a stronger, cleaner and stable Bangladesh.

ECONOMIC AND SOCIAL HIGHlIGHTS OF BANGLADESH

- Consistent GDP Growth Rate(last one decade) 6.0%

- Per Capita GNI $1,314

- Annual FDI Inflows $ 1.7 Billion

- Export Earnings of $30 Billion

- Foreign Exchange

- Reserve (2015) $26 Billion

- 127 million mobile subscribers (79% of total Population) and 48 million internet users (30% of Total Population)

- 25 million mobile banking subscriber with more than $50 Million daily transaction; Country-wide 4,500+ Digital Union Centers

- More than 8,100 MW(Daily) Electricity Generation (Installed Capacity of 11,600+ MW) and goal to generate 22,500 MW by 2020

- Global Recognitions of the achievements: Next Eleven Emerging Market (Goldman Sachs), Frontier Five (JP Morgan) etc.

WHY ECONOMIC ZONE IS A SOLUTION FOR BANGLADESH

- All existing 8 EPZs are almost fully occupied with tenants; but contributions of Industry and Service sectors to GDP are increasing.

- Unsystematic industrialization in and around Dhaka city without special incentive package; excessive pressure of people on Dhaka with huge traffic jam and environmental degradation.

- Country’s lion shares of FDI (More than 80%) comes from Telco and Gas & Petroleum; To attract FDI from different industries and diversify export, EZ is the best solution with comprehensive facilities & incentives.

- India, Vietnam, China, Philippines are ideal example of successful decentralized industrialization in EZs/SEZs for more than three decades. So why not Bangladesh?

WHY INVEST IN BANGLADESH

- Energy: The Government of Bangladesh guarantees uninterrupted power to EZ’s.

- Manpower: With the 8th largest population, 160 million Bangladesh blessed with “Demographic Dividend” from Day labor to senior management, are ready to work.

- Business Friendly: The Government of Bangladesh fully supports the EZ movement and has taken the initiative to establish100 new economic zones throughout the nation within 15 years.

- High-Growth Rate: Building on a consistent growth rate of 6% on average since 1994, the government of Bangladesh aims to transform the country into a middle income country by 2021.

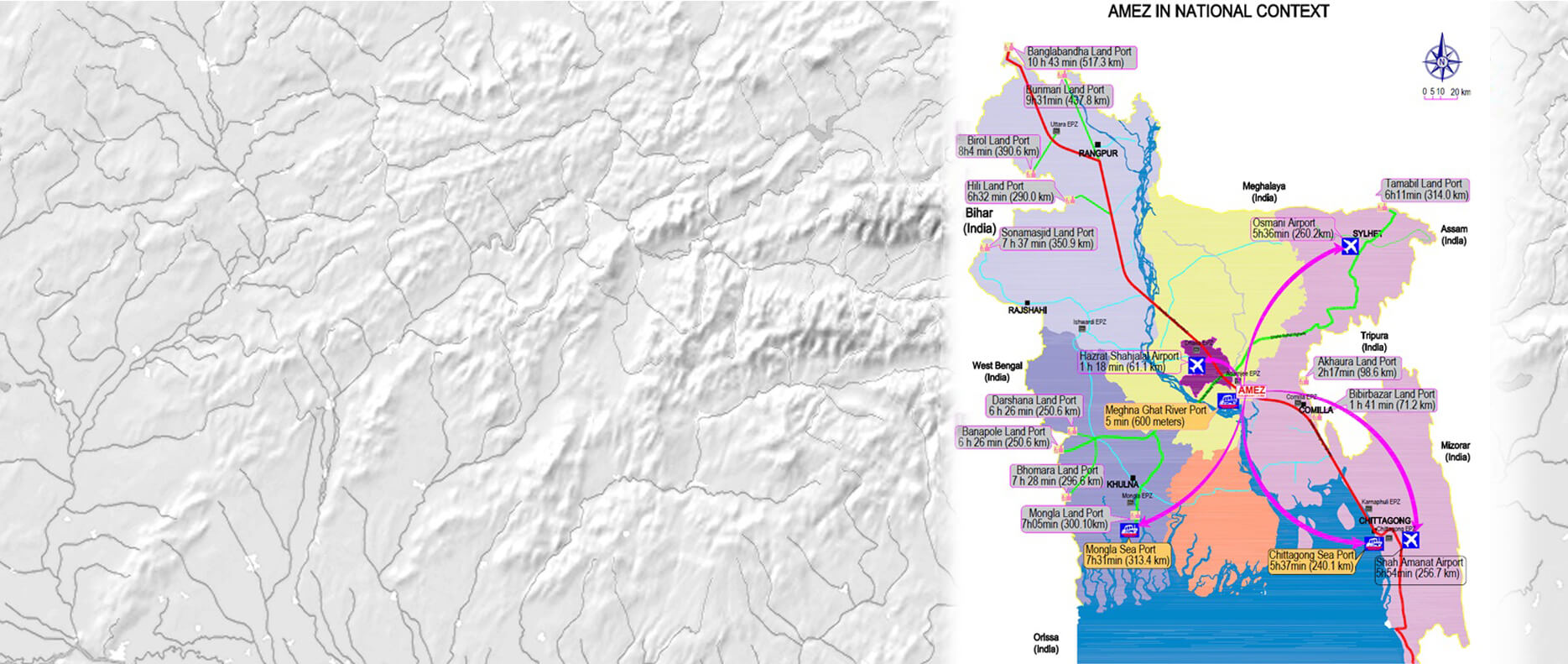

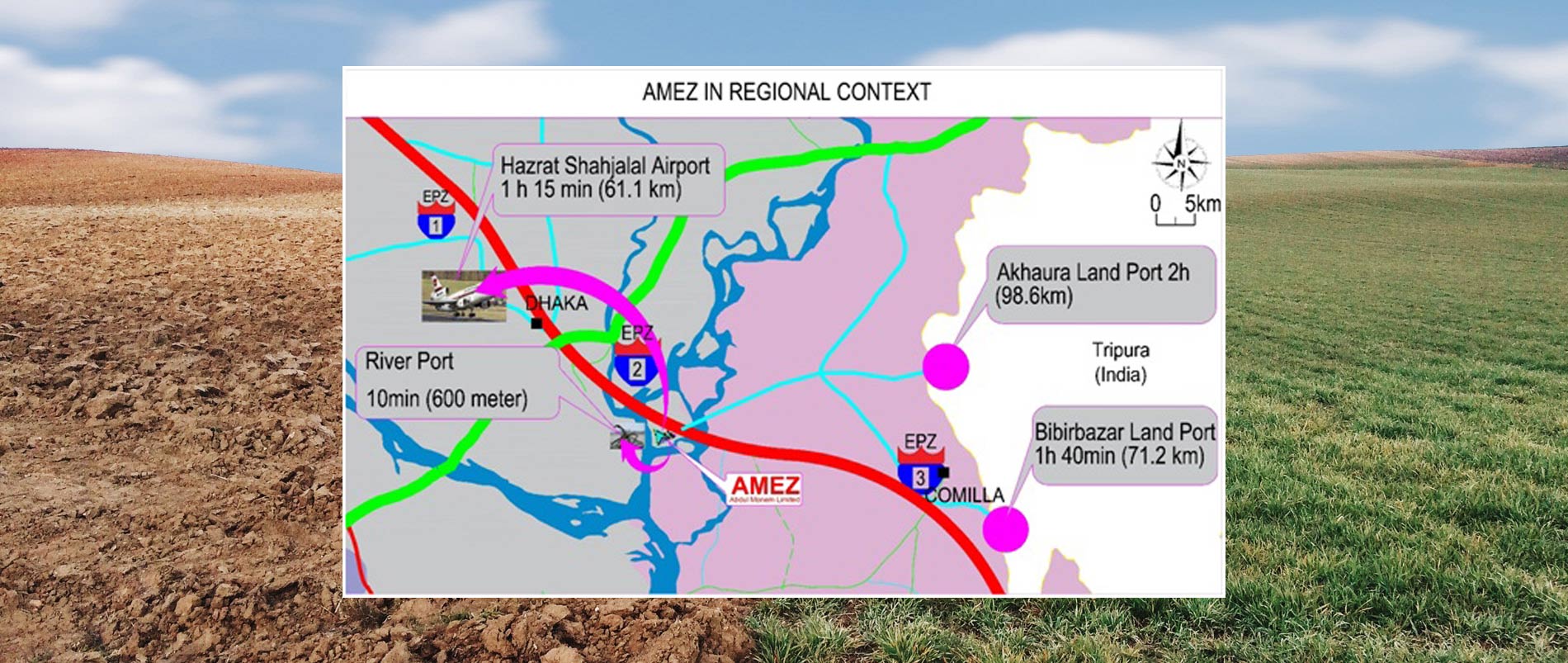

- Strategic location: Bangladesh being at the apex of the Bay of Bengal with India and other SAARC countries to the west, Japan, Korea, China and other ASEAN countries to the east, can emerge as a Mega Asian Growth Triangle for huge local and foreign markets.

- Performances of Existing EPZs are encouraging: Current performance of existing export processing zones (18%+ of national exports & 0.4 million employments) is favorable and encouraging.

INTERNATIONALLY COMPETITIVE INCENTIVES

- Tax Holiday: 1st and 2nd year: 100%, 3rd: 80%, 4th: 70%, 5th: 60%, 7th: 40%, 8th: 30%, 9th: 20%, 10th: 10%.

- Customs Duty: Duty free import of raw materials, construction materials, capital machineries, finished goods.

- Income Tax: Exemption from dividend tax (After tax holiday over) etc. (After tax holiday over) etc.